The Complete Guide to Home Loans in India

Dec 13th 2025

Loan

The Complete Guide to Home Loans in India, Owning a home is a dream for many in India, and a home loan often turns this dream into a reality. A home loan is a financial instrument that enables individ...

Read more...

How Can I Close a Personal Loan?

Dec 13th 2025

Personal Loan

How Can I Close a Personal Loan? More often, people need money for unexpected expenses like paying off bills, paying off debt, planning a wedding, purchasing the newest technology, or taking a sh...

Read more...

Does a Business Credit Card Affect Personal Credit Score?

Dec 13th 2025

Personal Loan

It's no secret that side hustlers and small company owners prefer to use business credit cards because they make it easier for them to handle their funds effectively and because they help with tax pre...

Read more...

Personal Loan Vs. Top-Up Loan: Which Is Better?

Dec 13th 2025

Personal Loan

Personal Loan Vs. Top-Up Loan: Which Is Better? Being emotionally and mentally free from concern for the unknowns in life is a major component of financial independence. Many people encounter ev...

Read more...

How to Secure Affordable Health Insurance for Chronic Diseases in India?

Dec 13th 2025

Health Insurance

The increasing prevalence of chronic diseases in India is creating a substantial financial burden on individuals due to rising healthcare costs. Accessing affordable health insurance for chronic condi...

Read more...

10 Essential Add-Ons to Enhance Your Motor Insurance in India 2025

Dec 13th 2025

Commercial Vehicle Insurance

Buying a motor insurance is mandatory in India. No matter whether you own a commercial vehicle or a personal car, you cannot be allowed to ride on roads without a valid third-party insurance cov...

Read more...

Engineering Insurance: A Complete Guide to Protecting Your Projects in 2025

Dec 13th 2025

Business Insurance

In the ever-evolving engineering world, where projects are becoming increasingly complex and risks are constantly changing, having the right insurance in place is important. Taking it lightly can resu...

Read more...

How to Finance Your Dream Wedding: A Complete Guide to Wedding Loans in India

Dec 13th 2025

Personal Loan

Your wedding day is one of life’s most magical moments—a celebration of love, unity, and new beginnings. In India, weddings are grand, vibrant affairs packed with traditions, elaborate rituals,...

Read more...

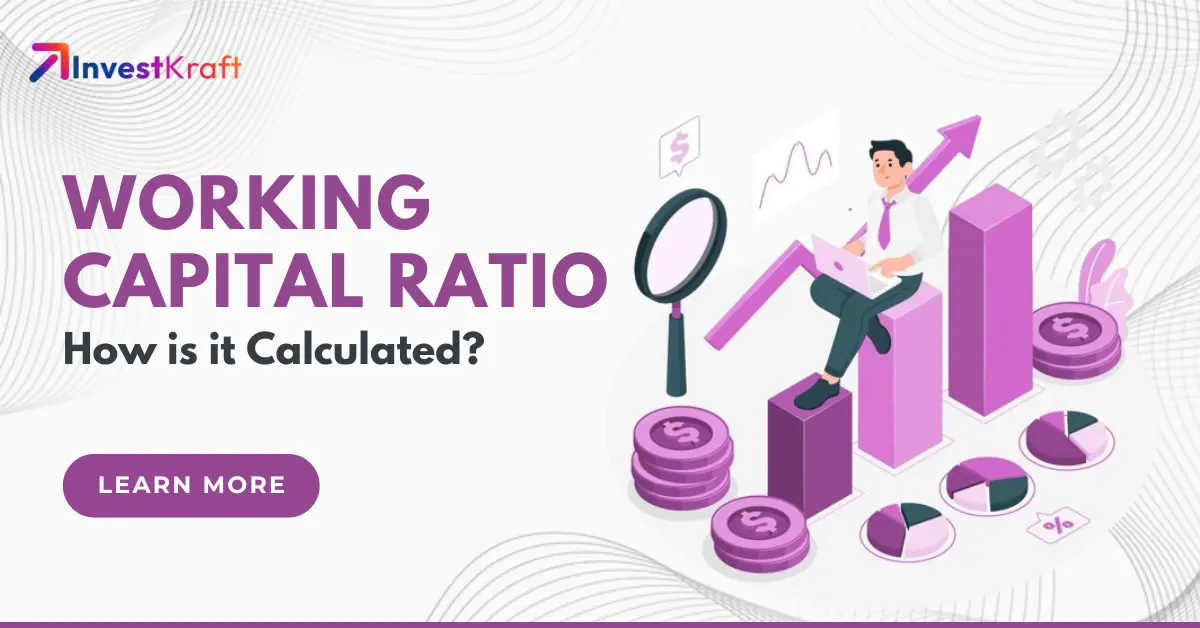

How to Check If Your Business is Running Smoothly by Assessing Your Working Capital Ratio?

Dec 13th 2025

Business Loan

To fully understand your company’s performance, examining various metrics that shed light on different aspects of the business is essential. The working capital ratio, or WCR stands out as a significa...

Read more...

Ultimate Guide to Getting a Small Business Loan in India 2024

Dec 13th 2025

Business Loan

Small business loans are a great option for entrepreneurs looking to invest in their businesses. They offer quick access to capital with fewer requirements, making it easier for small and medium busin...

Read more...

Blog Categories

Latest Post

Best Instant Loan Apps for Students in India 2026

Mar 9th 2026

Reach out to our Experts if you have any Doubts

Like the best things in life, Consultations @InvestKraft are free

Drop a Mail or give us a Missed Call & Begin your Investment Journey here