Top RBI Approved NBFCs in India 2026 – Updated NBFC List

NBFC full form is Non-Banking Financial Companies (NBFCs), and they play a critical role in India’s financial system by providing loans, asset financing, and credit services where banks may not...

Read more...

Best Government Schemes with High Returns in India 2026

Investing in government schemes is a smart way to grow your money safely. These plans are backed by the Government of India, so your principal amount is secure, and they offer steady returns wit...

Read more...

Best Money Earning Apps in India 2026: Real Apps to Earn Rs.100– Rs.1000 Daily Without Investment

In today's fast-paced digital world, earning money online without any upfront investment has become a game-changer for many Indians. Whether you're a student looking for pocket money, a homemake...

Read more...

Union Budget 2026: Expectations, Income Tax, Capital Gains & Key Reforms

The Union Budget 2026 is India’s annual fiscal plan for FY2026-27, outlining the government’s revenue and spending priorities. Article 112 of the Constitution defines the Budget as the governmen...

Read more...

Top RBI Approved P2P Lending Companies in India for 2026

Peer-to-peer (P2P) lending is a fast-growing alternative investment option in India that allows investors to earn higher returns by lending directly to borrowers through RBI-approved platforms.I...

Read more...

Top Government Banks in India 2026: List of Public Sector Banks & Comparison

Government banks, also known as Public Sector Banks (PSBs), form the backbone of India’s banking system. With their massive branch networks, digital services, and active role in implementing gov...

Read more...

Peer-to-Peer Lending in India: How It Works, Risks & Platforms (2026)

Peer-to-peer (P2P) lending in India is an alternative lending model where individuals lend money directly to borrowers through RBI-registered online platforms.In this guide, you’ll learn how P2P...

Read more...

Best Investment Options, Plans & Strategies in India 2026

Across India, beginners, salaried people, businessmen, students, and even retired individuals are searching for the same thing:“Which investment option is safe?”“Which investment plan gives the...

Read more...

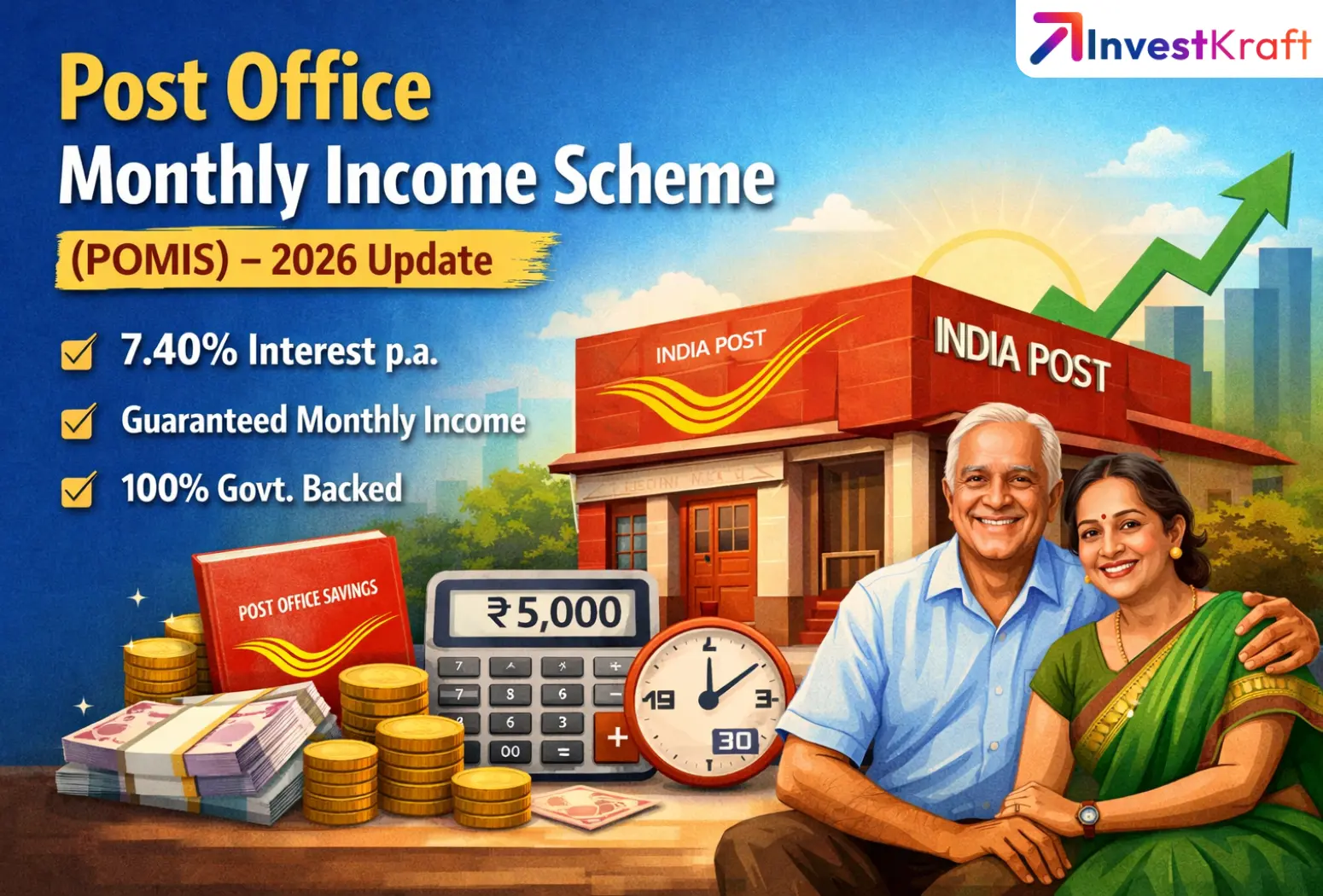

Post Office Monthly Income Scheme (POMIS) – Interest Rate, Benefits & Calculator 2026

Want to know a risk-free investment option with a high monthly return? Then we strongly recommend that you read this blog till the end. Let us first understand what POMIS or Post Office Monthly...

Read more...

List of Regional Rural Banks (RRBs) in India 2026

Regional Rural Banks or RRB bank play a vital role in India’s rural and semi-urban financial ecosystem. In this article, we present a list of the top Regional Rural Banks in India and their key...

Read more...Blog Categories

Latest Post1

Best Government Schemes with High Returns in India 2026

Jan 23rd 2026

Reach out to our Experts if you have any Doubts

Like the best things in life, Consultations @InvestKraft are free

Drop a Mail or give us a Missed Call & Begin your Investment Journey here