What is Net Present Value and How to Calculate it?

In the world of finance, Net Present Value or NPV is one of the widely used terms among experts. Despite being such an important term, not many people know it. The Net Present Value (NPV) refers to a method that helps people determine the easiness of investment in a business or project. Put simply, NPV refers to the existing worth of future cash flows in comparison to what was invested initially. In this post, let’s delve deeper and learn more about Net Present Value.

What is Net Present Value (NPV)?

The probability of an investment, project, or business for the future can be accessed by determining its Net Present Value. The NPV of an investment is intrinsically the total discounted to the present value of all future cash flows during the investment's tenure.

When comes to developing a budget, a majority of corporations frequently determine the net present value for the effective utilization of the available funds. Finance experts are better skilled and positioned to make strategic judgements by bringing each investment alternative or possible project down to the same level – how much it will be worth in the end.

How to Calculate NPV

The most common application of NPV is related to the corporate finance domain. For instance, investment bankers try to do a comparison between the net present values of a project with its initial value. This helps them check the feasibility of an investment before deciding to merge or acquire a business.

NPV is used primarily in corporate finance. For example, investment bankers may compare net present values to determine which merger or acquisition is worth the investment. Apart from this, some accountants, such as certified management accountants, may also use NPV when it comes to managing budgetary things and prioritizing projects.

Business owners can also benefit from understanding how to calculate NPV to help with budgeting decisions and to have a clearer view of their business’s value in the future.

Formula to Calculate NPV

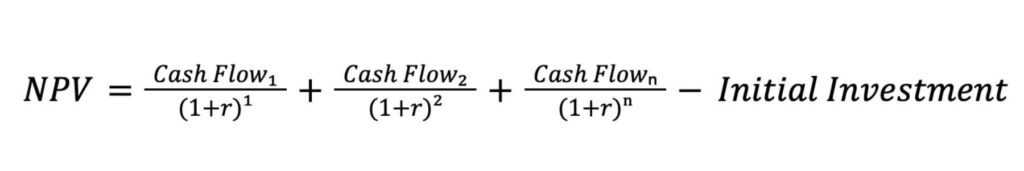

The measurement of the Net Present Value (NPV) is done by calculating the cash flows for every tenure of the investment, discounting them to existing value, and reducing the primary investment from the addition of the discounted cash flows of the investment or project.

The formula for NPV calculation is:

Whereas,

- Cash flow refers to the total amount invested and accrued on an investment over a specific time.

- N denotes the total number of tenures

- R refers to the rate of interest

Calculate Your Net Present Value- NPV Calculator

Elements of NPV

There are three elements of NPV including:

- Cash Flow: Cash flows refer to the amount that is accrued or spent for the benefit of the investment. For example, interest and loan repayments as well as capital outlays come under cash flow. The cash flow for each period includes both inflows for earnings, revenues, and dividends as well as outflows for costs.

- No. of Periods (n): The number of periods in a project or investment determines the number of months or years it will endure. Due to the typical longevity of a business, the default setting for the number of periods typically remains 10 years. However, some investments, businesses, and projects could have more precise timetables.

- Rate of interest (r): The interest rate refers to a business’s weighted average cost of capital (WACC). A company’s WACC refers to an amount that is needed needs to justify the cost of operating and includes things like the company’s interest rate, loan payments, and dividend payments.

Read Also: 8 Proven Strategies for Smart Loan Repayment

NPV Example

An investor is judging the profitability of an investment project with a primary investment of ₹50,000. The project is assumed to produce a revenue of ₹10,000, ₹27,000 and ₹20,000 in three years with an interest rate of 12%.

The cash flow over three years differs and requires the summation of individual cash flow results in the required net present value to determine the profitability.

- Cashflows are ₹10,000, ₹27,000 and ₹20,000

- Rate of interest: 12%

- Period: 3 years

- Primary investment: ₹500,000

- NPV = ∑ (Cashflow/(1+i)^t)-initial investment

- NPV = [10000/(1+0.12)^1]+[27000/(1+0.12)^2]+[20000/(1+0.12)^3]-50000

- NPV= ₹ -5,312

Types of NPV Results

There can be three probable outcomes of NPV:

- Positive NPV: A positive NPV outcome simply means that the project or investment is profitable and it is good to go with the same.

- Negative NPV: A negative NPV means the project or investment is not likely to generate profit in the future and hence, it should not be chosen.

- Zero NPV: A nil NPV means that that investment would remain neutral, resulting in no profit and no loss. However, investors can still go with such investment and projects and investments if the project offers various imperceptible benefits, like brand positioning, strategic advantage, or better client satisfaction.

NPV Limitation

Below are some of the limitations of NPV that you should know.

- Discounting rate: The need to calculate the rate of return is the basic downside of Net Present Value. A higher rate of return can lead to a falsely negative NPV, while a lower rate of return assumption may refer to a falsely profitable project. Overall, it can cause careless decision-making.

- Incompatibility of Different Projects: When it comes to comparing two projects belonging to different times, NPV is not usable. NPV cannot be used to compare two projects that differ in length of time or risk level because a majority of business organisations operate on fixed budgets and occasionally have two project possibilities.

- Multiple Assumptions: The NPV technique tends to ask for several inputs and outflow assumptions. There is a probability that various expenses may be undiscoverable until after the project kicks off. Additionally, inflows cannot always match expectations. The majority of software today does the NPV analysis and helps managers make decisions. The NPV technique for capital planning is popular despite its flaws since it is highly useful.

An investment carrying a negative NPV will likely result in a financial loss and may not be made, whereas projects or investments with a positive NPV will often be lucrative and so approved for consideration.

Factors Affecting Net Present Value (NPV)

Several factors can significantly impact the net present value (NPV) of a project or investment. These crucial factors are listed below.

- A higher discount rate results in a lower net present value due to the decreased worth of future cash flows. When the discount rate is raised, it diminishes the value of future cash flows compared to a scenario with a lower discount rate.

- The NPV increases with longer projects as they provide ample time for revenue generation and return on investment

- A higher initial investment leads to a lower NPV as more revenue must be generated to achieve a return on investment.

- Receiving cash flows earlier in a project increases its NPV, as the ability to reinvest these funds allows for earlier returns. This is due to the potential to generate more returns on investment with the earlier cash inflows. Therefore, the timing of cash flows is critical in determining the overall NPV of a project.

- Projects with predictable cash flows tend to have a higher NPV as they inspire greater confidence in generating returns on investment. Therefore, the more reliable the cash flows, the more positive influence it has on the NPV.

Are There Any Advantages /Disadvantages of Using NPV?

A positive NPV denotes a good recovery, and a negative NPV indicates a low return. Below is a summary of the advantages and disadvantages of NPV.

| Advantages of NPV | Disadvantages of NPV |

| The main advantage of using NPV is that it incorporates the time value of money, recognizing that money available now is more valuable than the same amount in the future due to its potential to earn returns. | The computation of NPV relies on discounting future cash flows to present value using the required rate of return, but there are no specific guidelines for determining this rate. Companies have discretion in deciding this percentage value and there may be inaccuracies in NPV due to errors in the chosen rate of return. |

| NPV calculates the discounted net cash flows of an investment to assess its profitability. This highlights the significance of present value in capital budgeting. | Another drawback of NPV is its inability to compare projects of varying sizes, as it measures absolute value rather than a percentage. Consequently, larger projects tend to yield higher NPV figures than smaller ones. Thus, while the smaller project may generate higher returns relative to its investment, its NPV could still be lower overall. |

| The NPV method plays a crucial role in aiding companies in their decision-making process. It not only facilitates the evaluation of projects of similar scale but also assists in determining the profitability or potential losses associated with specific investments. | NPV only considers the cash inflows and outflows of a project and ignores hidden costs, other preliminary costs and sunk costs. As a result, the profitability of the project may not be entirely accurate. |

What are the Common Mistakes in Net Present Value (NPV) Calculation?

Calculating the net present value (NPV) of a company requires utmost precision to avoid common pitfalls. Let’s take a closer look at some of the most recurrent mistakes one should be aware of -

- Properly discounting cash flows is crucial for accurate NPV calculation, as it requires using the appropriate discount rate corresponding to the project’s risk. If the discount rate is too high, the NPV may appear lower than it is and if the rate is too low, the NPV may seem artificially high. Therefore, it is essential to ensure the selection of the correct discount rate to avoid inaccurate NPV assessment.

- Incorrectly estimating future cash flows can significantly affect the accuracy of NPV calculations. This often occurs when revenue and expense projections are overly pessimistic or optimistic, resulting in an inaccurate NPV. It is essential to carefully assess and adjust these estimations to ensure the reliability of the NPV calculation.

- Ignoring the time value of money is a mistake that many people make when calculating NPV. This error can result in an overestimated NPV because it assumes that all cash flows have the same value regardless of when they are received.

- Another mistake to avoid when calculating NPV is not considering all the cash flows associated with the project. It is important to include both positive and negative cash flows that will occur throughout the project’s lifespan. Neglecting to account for any cash flows can lead to a misleadingly low or high NPV result.

FAQs

1. Can I Include All Cashflows During NPV Calculation?

The NPV of an investment is essentially the total discounted to the present value of all future cash flows during the investment's lifespan. When creating a budget, businesses frequently utilise the net present value calculation to determine how and where to spend money.

2. What Is Not There In The NPV?

The fundamental guideline is that all costs and benefits that will be impacted by the choice to be made should be included in an NPV model. These are known as the pertinent costs and benefits. The exclusion of irrelevant costs and benefits is necessary because they could influence the choice in erroneous ways.

3. How Does Inflation Affect The NPV?

Instead of using the accrual method of accounting to assess long-term investments, NPV and IRR assessments do so using cash flows. To meet the necessary rate of return, which already takes inflation into account, cash flow estimates must incorporate adjustments for inflation.

The Conclusion

The difference between the present cash value and the worth of cash in future is determined through Net Present Value (NPV) With Investkraft. In project management, net present value (NPV) is primarily utilized to ascertain if the assumed financial benefits of a project will surpass the current investment, indicating that the chosen investment or project is a worthy endeavour.

Related Posts:

- What is the SIP Calculator and Its Benefits?

- PPF Calculator – Why & How to Use it?

- What is a Simple Interest Rate and How to Calculate It?

- What is a GST Calculator and How Does It Work?

- What is an ELSS Calculator and How Does it Work?

- How to Calculate HRA?

Verify Phone Number

Related Post

CIBIL Score Check Guide 2026: How to Check, Improve & Understand Your Credit Score

CIBIL score full form is Credit Information Bureau (India) Limited Score and it is one of the...

Read more...

NBFC vs Bank for Personal Loan in India: Key Differences, Interest Rates & Which is Better?

When it comes to personal finance, choosing between an NBFC (Non-Banking Financial Company) and a tr...

Read more...

20 Best Money Earning Websites Without Investment in India with UPI Withdrawals 2026

Looking to make some extra cash from home in 2026? You're in luck. With the rise of digit...

Read more...

Best Government Schemes with High Returns in India 2026

Investing in government schemes is a smart way to grow your money safely. These plans are back...

Read more...

Union Budget 2026: Expectations, Income Tax, Capital Gains & Key Reforms

The Union Budget 2026 is India’s annual fiscal plan for FY2026-27, outlining the government’s...

Read more...

Post Office Monthly Income Scheme (POMIS) – Interest Rate, Benefits & Calculator 2026

Want to know a risk-free investment option with a high monthly return? Then we strongly recomm...

Read more...

Top Fintech Companies in India 2026 – Updated List, Services & Insights

With the advent of AI and digital payment methods, India has recently seen a surge in fintech...

Read more...

Bank Holidays in India 2026: Complete State-wise RBI List

Before you head out to carry out your important banking activities in 2026, please read this b...

Read more...

How to Get Free From the Debt Trap in 2026

There is a moment in everyone’s financial life when they look at their credit card bill and wo...

Read more...

10 Real Ways to Increase Your Income in 2026 (No Fake Apps, No Scams)

Are you cutting back on your dreams because your income isn’t enough? Or Are rising expenses f...

Read more...Reach out to our Experts if you have any Doubts

Like the best things in life, Consultations @InvestKraft are free

Drop a Mail or give us a Missed Call & Begin your Investment Journey here